The year 2021 was intricate- both because of the confusion brought up by the Covid pandemic, and the eventual consequences that followed the perpetual presence of the pandemic: an economic crisis.

Topping over 200 million cases and millions of deaths from the virus had certainly distinguished our lives in 2021 from any other years.

Consequently, since the late months of 2020 and on, the United States signified its intentions for supporting all citizens suffering from job losses, medical unavailabilities, and death. Likewise, trillions of dollars were pumped into the economy through Quantitative Easing, a process of which more money is influx to generate “neutrality.”

These were to protect the lives and livings of many affected by the virus and to restore the economic growths through accessibility of currency.

Such help may still be seen through the months secured by the financial help and active support by the government, though, issue expands beyond the financial scope.

Earlier this year, the Federal Reserve announced its future plans for tapering-an increment for interest rates through unwinding its treasury bonds.

Customarily, these types of actions are made to compensate Inflation, or to protect paper currencies from deteriorating. This year alone, the consumer prices have soared for over 7.7 percent, surpassing the record highs in nearly 40 years. This includes each of 33% for shelters, 13% for food, 8% for medical uses.

Nathan Park, a junior from Troy HS describes the current inflation as “ a bad time to buy anything besides the necessities”, describing his experiences with facing increased prices of technology.

Having to pay more doesn’t seem very pleasant and is not an effort that can be made by any one individual, rather it should be a task of the country to readjust.

Howerver, there are still options to reduce stress from current inflation: Purchasing physical values (Eg. Gold, silver, valuables), investing in cryptocurrencies, or even investing in ETFs or stocks with high dividend yields (Eg. SPY, VOO, VYM, VIG).

One the positive note, many professionals are expecting severe inflation to fade within the preceding 12 months. In fact, the utmost priority among individuals is how they would utilize the crisis to spend their next months for the better.

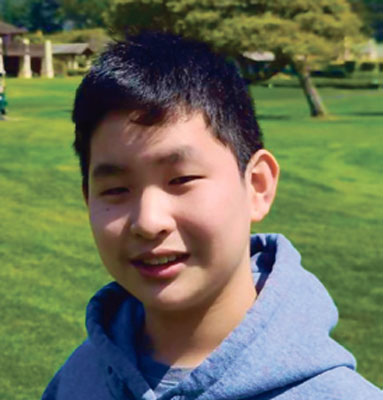

Ryan Jung

8th Grade / Kraemer MS

<

Ryan Jung 8th Grade / Kraemer MS>